LEAD GEN METHODS > REVIEWS

The Three Most Common Lead Generation Methods for Mortgage Brokers - Reviewed & Ranked for 2025

Plus, 2 free ways to get more clients most brokers overlook...

By Adam Dowd | Wednesday, 03/12/2025

For mortgage brokers, a steady stream of high-quality leads is the difference between a thriving business and struggling to get by. In today’s digital world, social media advertising offers an incredible opportunity to attract potential clients - but not all lead generation methods are created equal.

In this article, we’ll break down three common methods mortgage brokers use to generate leads and reveal the best approach to ensure long-term success.

Option 1: Buy leads through a third-party provider (pay-per-lead)

Overall Rating: F

Many brokers are drawn to pay-per-lead services because they offer a quick and seemingly easy way to get new prospects. However, these services come with significant downsides.

Pros:

Quick to get started

Cons:

Leads don’t know who they will be speaking to, making initial conversations difficult.

The focus is on collecting financial data rather than building relationships.

Providers often use unrealistic advertising claims, attracting leads with misleading expectations.

The result? Brokers end up with cold leads who are difficult to convert. This approach may generate volume, but it rarely leads to consistent, high-quality deals.

Option 2: Hiring an agency to build & manage your funnel

Overall Rating: C

Another popular option is to hire an agency to run your lead generation campaigns. This is a step up from pay-per-lead services because the advertising is tailored to your brand.

Pros:

Personalized marketing that helps build relationships with potential clients.

Leads sometimes initiate contact, creating a warmer introduction.

Cons:

Expensive to set up (agencies often charge $6,000+ upfront).

High ongoing costs make this approach difficult to sustain.

Since mortgage brokers don’t get paid until settlement (8-12 weeks), they must carry marketing costs for months before seeing a return.

While agencies can provide quality leads, the high cost and long ROI cycle make this a challenging option for many brokers.

Option 3: Learning to generate leads yourself (with guidance)

Overall Rating: A

The best long-term approach is learning how to generate leads yourself. This allows brokers to run their own campaigns under their brand name and keep marketing costs manageable.

Pros:

Leads are generated under your own brand, helping establish rapport before the first call.

Highly cost-effective, with minimal upfront investment.

When done correctly, it provides long-term stability and better ROI.

Cons:

There’s a learning curve to understanding social media advertising.

While the initial learning phase can seem daunting, having the right training and tools dramatically shortens the time it takes to see results.

The key to successful lead generation using social media

Regardless of the method you choose, the success of any lead generation strategy depends on three key factors:

1) Building Rapport with Leads: The best leads come from people who feel comfortable speaking with you. Establishing trust before the first call significantly increases conversion rates.

2) Consistency in Lead Flow: Brokers need a system that generates quality leads consistently - not just a one-off boost.

3) Financial Viability: Marketing isn’t a one-time expense. It must be sustainable over time to ensure long-term business growth.

With these principles in mind, the best path forward is clear: mastering lead generation yourself is the most effective and financially viable solution.

Introducing: Broker Branded Leads 2.0

To help brokers fast-track their success, we’ve developed Broker Branded Leads 2.0 - a powerful software and training combination designed to make lead generation easy and effective.

Here’s what makes Broker Branded Leads 2.0 different:

Get Leads Within Hours – Using our done-for-you templates, you can be up and running in just 3-4 hours.

No Huge Upfront Costs – Unlike agencies that charge thousands, the initial investment is less than $50.

Proven Track Record – Our system has helped numerous brokers generate a positive ROI, with long-term success.

Two Guarantees – We stand by our training and software with guarantees to ensure your success.

Ready to start generating your own leads?

If you’re tired of wasting money on overpriced leads or costly agencies, it’s time to take control of your own marketing.

Learn how to turn on new conversations with referral-like leads today and convert them into deals.

BONUS!

2 free ways to get more clients that most brokers overlook...

MORE REFERRALS

Get more referrals coming in without hassling clients...

Referrals are the best. But they dry up because brokers stop asking and don’t motivate their clients enough - hint: a $50 Coles voucher for a new client referral won’t cut it.

Learn how to structure formal referral programs and automate referral requests every single day.

MORE REVIEWS

Grow Google reviews so you rank higher...

Did you know 87% of consumers consult Google Reviews when assessing a new business?

When you automate and optimise your Google Review requests you begin to appear higher on Google and get more local clients.

What you get

“The Main Thing”

Setup in our ‘pay-per-opportunity’ lead generation program, delivering exclusive, SMS-verified refinance leads direct to your inbox.

One small setup fee, then you’re only charged when a lead hits your inbox. No upfront payments in the thousands and thousands of dollars.

“The Other Things”

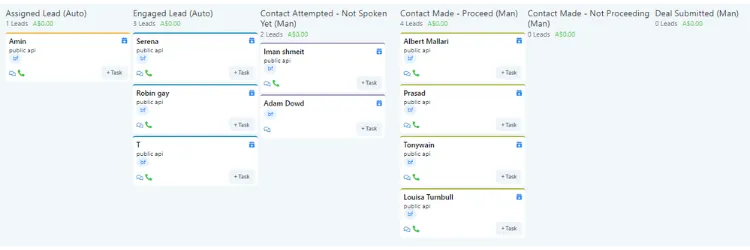

1) Free account in our lead nurture & management system, ActiveClient.

Track new leads along the sales pipeline, make notes against each lead, set reminders for follow up.

2) 30-day email follow up sequence in place, branded for you.

Aimed at both informing new leads about the refinance process and getting them wanting to reach out to you, if you haven’t managed to make contact with them yet. Put in place to maximise your conversion rate as much as possible.

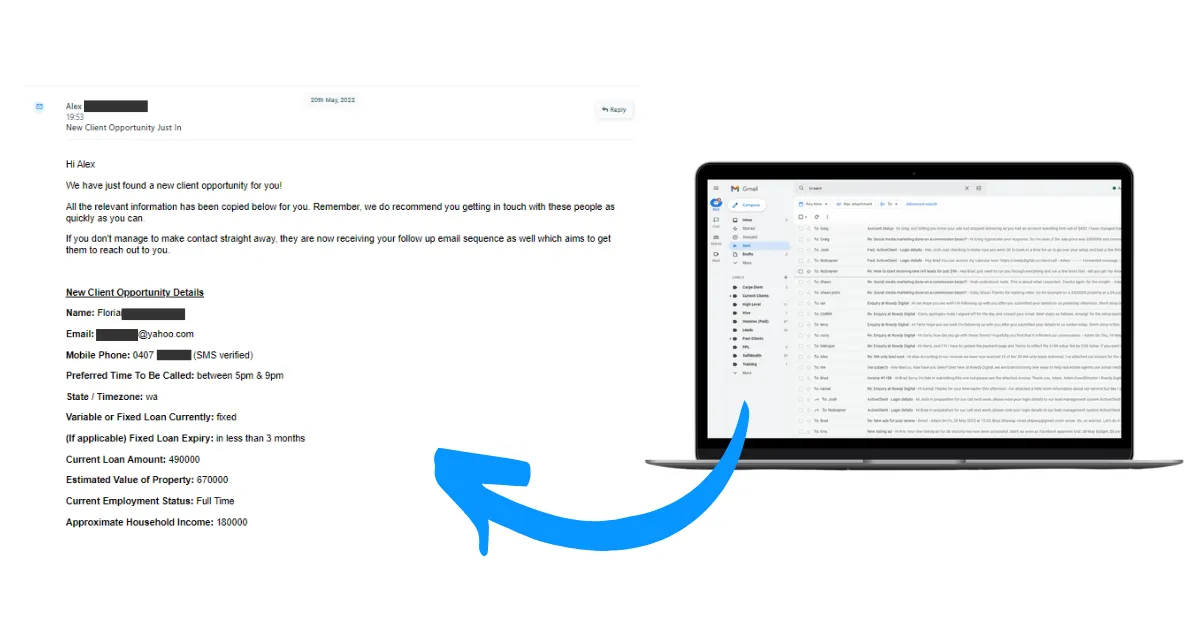

What does the broker see

The broker receives real-time notifications popping up in your email inbox and SMS to your phone as soon as a lead has successfully completed our vetting process. The broker notification is sent within minutes.

Here's what the emails look like:

Information includes: Name, Email, Phone (SMS-verified), Preferred Time To Be Contacted, State / Timezone, Loan Type, Current Loan Amount, Estimated Property Value, Current Employment Status, Approximate Household Income.

Standard Filters: Leads are rejected when;

- Current Employment Status = Unemployed

- Loan Type = Fixed, with a fixed period remaining of more than 3 months

- Loan Amount = Less than $250K

What are the pricing options

There are two program options for brokers to select from: the Broker Starter Program which is an initial 30 day period, or the Broker Growth Program which is an initial 90 day period and discounted lead pricing is available.

Broker Starter Program

$249 Setup Fee ($499)

Up & Running in 3-5 Business Days

Agree to 15 Leads

Program Period 30 Days

Access to ActiveClient Lead Management System

30-Day Email Follow Up

Pay Only As You Get Leads!

$120 per lead, incl. GST

Broker Growth Program

Broker Growth Program

$249 Setup Fee ($499)

Up & Running in 3-5 Business Days

Agree to 15 Leads Per Month

Program Period 90 Days

Access to ActiveClient Lead Management System

30-Day Email Follow Up

Pay Only As You Get Leads!

$105 per lead, incl. GST

What to do next...

At this point, I'm going to assume you're in one of two categories:

Category 1 - You Want to Talk to Find Out More

Excellent! Here's your options: give me a call right now - 0403 176 532. I'll be happy to answer any questions you have.

Or you can book a time that suits you by clicking the button below, and we'll catch up on Zoom.

Category 2 - You're Ready To Get Started

Perfect! The first step is to secure your place by taking care of the setup fee, then we will get the Terms of Agreement over to you to digitally sign. The Terms are also linked on the payment page should you wish to review these first.

Once we get you setup in our system (takes 3 to 5 business days) we will schedule a Zoom call with you to run you through how everything will work and test your system.

After that call, you're ready to go live and started receiving leads!

Amateur brokers do this...

Let's say you qualify for refinancing - yay!

Most brokers are just going to get a better rate - which is fine... But there is so much being left on the table!

For example, a $550,000 loan refinanced from 2.69% to 1.89% will save $65,547* in total.

Good - yes. But let's see what professional brokers can do for you.

But wait, there's one more!

Make sure those amateur brokers are not secretly working in the bank's interests!

If you only had 25 years left to pay off your loan, don't let that broker extend it back to 30 years!

You'd pay another $26,314* in interest and take 5 years longer to pay it off!

Who is AskCharlie?

AskCharlie.com.au is like that knowledgeable guy/gal everyone turns to for solid advice.

Here, we provide Aussie families with awesome mortgage slashing information - because we are passionate about Aussies getting the best deal possible.

We also connect busy homeowners with our legendary mortgage brokers, saving you time, effort & stress searching for a great broker!

How do we help...

We scour the country to find the very best brokers - so you don't have to!

No Googling, no dodgy referrals... none of that.

We've already checked our broker's eligibility to get you the best deal, leaving nothing to chance.

If you'd like to access one of our legendary brokers, simply complete the 30-second form on this page.

More clients, more ways. Everything mortgage brokers need to grow their businesses online.

92 Rupert Street, Collingwood VIC 3066

92 Rupert Street, Collingwood VIC 3066

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

Copyright © 2025 – All Rights Reserved. Rowdy Digital is a trading name for Rowdy Investing Pty Ltd which is a registered company in Australia. ACN: 159 349 667.